WHO IS

Constance Carter?

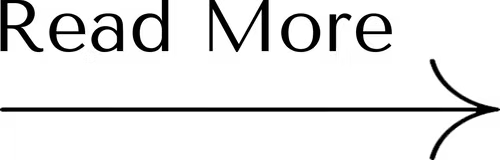

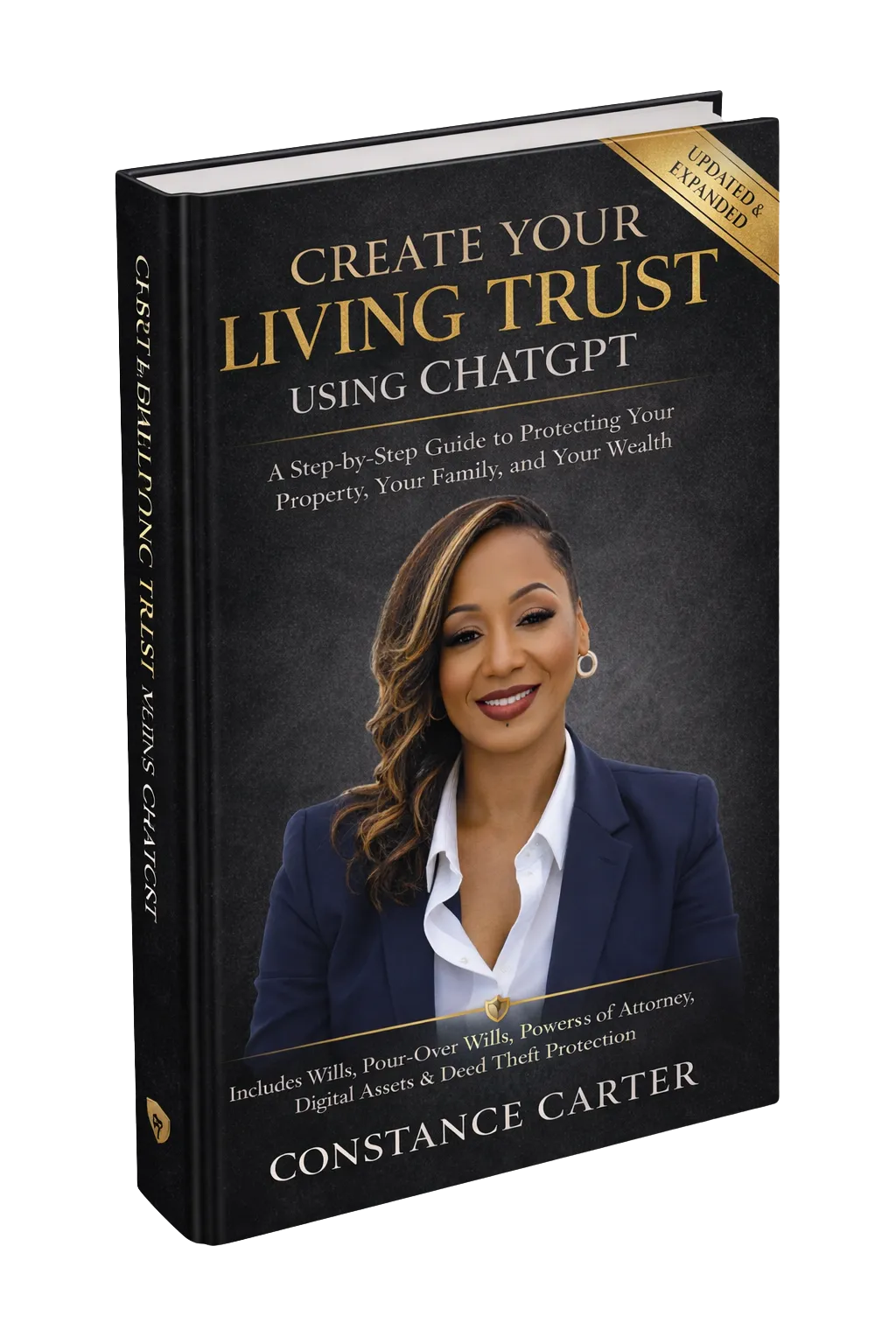

Constance is not your typical individual; she's a dynamic force of nature, a true wealth activist on a mission to redefine possibilities. With a remarkable journey that has seen her achieve historic milestones, she is a trailblazer in multiple domains. As the founder of California's largest independent African American owned real estate firm, a prolific Author with best-selling books, a TEDx speaker with a nearly half-million views, a savvy Cannabis Investor, and...

The Grow Your Money

(GYM) Podcast

is your go-to space for unapologetic conversations around wealth, wellness, wisdom, and winning in every area of life. Hosted by Constance Carter, wealth educator, real estate mogul, and founder of the Net 7 Nation, this podcast is more than just financial talk — it’s a movement to close the wealth gap and raise our collective consciousness.

Every week, we break down the keys to building generational wealth, investing with intention, healing our money mindsets, and living with divine purpose. Whether we’re talking real estate, relationships, business, credit, or culture — we’re bringing you the truth, the tools, and the transformation.

Expect deep dives, powerful guest interviews, money moves, and real talk for the culture. This isn’t just a podcast. This is your financial fitness center — and it’s time to get in the GYM.

New Episodes

Money Mondays

Wellness Thursdays with Dr. Shirley Jones

Weekly GYM Masterclass

TESTIMONIALS

SEE WHAT PEOPLE ARE SAYING ABOUT ME

Book Me To Speak

Subscribe to my Mailing List

Constance Carter

Wealth Educator | Author | Speaker

Helping individuals and families build, grow, and protect wealth through education, strategy, and community.

© 2026 Constance Carter. All Rights Reserved.